Intrinsic Value

Intrinsic Value: A Comprehensive Guide

Intrinsic value is a central concept in investing, particularly in the fields of stock valuation, options pricing, and financial analysis. It refers to the true, inherent worth of an asset, independent of its current market price. Unlike market value, which fluctuates based on supply and demand dynamics, intrinsic value represents the underlying or "real" value of an asset, which may or may not be reflected in its market price. Understanding intrinsic value is crucial for making informed investment decisions, as it helps investors determine whether an asset is overvalued, undervalued, or fairly priced in the market.

In financial analysis, determining the intrinsic value of an asset—whether it's a stock, bond, or other investment—is a key component of value investing. Investors often compare the intrinsic value to the current market price to assess the potential for price appreciation or depreciation.

The Concept of Intrinsic Value

The concept of intrinsic value can be broken down into two main areas:

Stocks and Equities: For stocks, intrinsic value represents the present value of all future expected cash flows (dividends, earnings, etc.) from the stock, adjusted for risk. Intrinsic value is a way of estimating the fair value of a company's stock by considering its fundamentals—such as earnings, revenue growth, and the overall economic environment—rather than relying solely on its current trading price.

Options: In the context of options, intrinsic value refers to the difference between the current price of the underlying asset and the strike price of the option. For call options, intrinsic value is the amount by which the stock price exceeds the strike price, while for put options, it’s the amount by which the strike price exceeds the stock price. In both cases, intrinsic value represents the amount of profit that could be realized if the option were exercised immediately.

Calculating Intrinsic Value of Stocks

The intrinsic value of a stock is often determined using discounted cash flow (DCF) analysis. This method involves estimating the company's future cash flows and then discounting them back to the present using an appropriate discount rate. The sum of these discounted cash flows represents the intrinsic value of the stock.

Steps for Calculating Intrinsic Value of Stocks:

Estimate Future Cash Flows: Start by estimating the company's future cash flows, which could include earnings, dividends, and free cash flows. These projections are typically made for several years into the future.

Determine a Discount Rate: The next step is to choose an appropriate discount rate. This rate is often based on the company’s cost of capital, which accounts for both debt and equity financing. The discount rate reflects the risk of the investment and the time value of money.

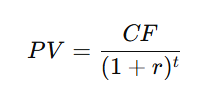

Discount the Cash Flows: Discount each of the future cash flows back to the present value using the chosen discount rate. The present value of each future cash flow is calculated using the formula:

Where:

PPV is the present value of the cash flow.

CF is the cash flow for a specific year.

r is the discount rate.

t is the number of years into the future.

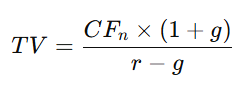

Calculate the Terminal Value: After estimating the cash flows for a certain number of years, you need to calculate the terminal value. This represents the value of the company’s cash flows beyond the forecast period, assuming a stable growth rate. The terminal value is often calculated using the Gordon Growth Model:

Where:

TV is the terminal value.

CF_n is the cash flow in the final year of the forecast period.

g is the perpetual growth rate of the cash flows.

r is the discount rate.

Sum of Discounted Cash Flows: The intrinsic value of the stock is the sum of the present value of all projected cash flows, plus the present value of the terminal value. If the resulting intrinsic value is greater than the stock’s current market price, the stock is considered undervalued, and vice versa.

Intrinsic Value of Options

The intrinsic value of options is relatively straightforward to calculate and is based on the relationship between the option's strike price and the current market price of the underlying asset.

Call Option Intrinsic Value:

For a call option, the intrinsic value is the amount by which the stock price exceeds the option’s strike price. If the stock price is higher than the strike price, the option has intrinsic value.

Intrinsic Value (Call) = Stock Price − Strike Price

If the stock price is lower than the strike price, the intrinsic value is zero, as the option would not be exercised.

Put Option Intrinsic Value:

For a put option, the intrinsic value is the amount by which the strike price exceeds the stock price. If the stock price is lower than the strike price, the option has intrinsic value.

Intrinsic Value (Put) = Strike Price − Stock Price

Again, if the stock price is higher than the strike price, the intrinsic value is zero.

The Importance of Intrinsic Value in Investing

The concept of intrinsic value is fundamental to many investment strategies, especially value investing, which seeks to identify stocks or assets that are undervalued relative to their intrinsic value. Some key reasons why intrinsic value is so important include:

Identifying Undervalued or Overvalued Assets: Investors use intrinsic value to determine whether an asset is trading for less than (undervalued) or more than (overvalued) its true worth. By comparing the market price with the intrinsic value, investors can identify opportunities for profit.

Long-Term Investment Strategy: Intrinsic value focuses on the underlying fundamentals of an asset, which makes it a valuable tool for long-term investors. Unlike market value, which is subject to short-term fluctuations, intrinsic value reflects the true earning potential of an asset over time.

Risk Assessment: Assessing intrinsic value allows investors to evaluate the risk associated with an investment. If the market price is significantly higher than the intrinsic value, the investment may be more risky, as the price could fall back to a more realistic level.

Guiding Investment Decisions: Intrinsic value helps investors make decisions based on the long-term outlook of an asset rather than short-term market noise. By focusing on intrinsic value, investors can better withstand market volatility and remain committed to their investment strategy.

Factors Affecting Intrinsic Value

Several factors can impact the intrinsic value of an asset, particularly in the context of stocks:

Earnings Growth: The expected growth of a company’s earnings directly affects its intrinsic value. A company with strong earnings growth prospects will typically have a higher intrinsic value.

Discount Rate: The discount rate used in calculating the intrinsic value plays a significant role. A higher discount rate reduces the present value of future cash flows, lowering the intrinsic value, while a lower discount rate increases the intrinsic value.

Risk and Uncertainty: The perceived risk of an investment affects its intrinsic value. Higher risk leads to a higher discount rate, which reduces the intrinsic value. Conversely, lower perceived risk leads to a lower discount rate and a higher intrinsic value.

Market Conditions: Broader market conditions, such as interest rates, inflation, and overall economic health, can affect the intrinsic value of assets. For example, rising interest rates can reduce the present value of future cash flows, lowering the intrinsic value of stocks or bonds.

Limitations of Intrinsic Value

While intrinsic value is a powerful tool, it does have some limitations:

Subjectivity: Estimating future cash flows and selecting an appropriate discount rate can be subjective. Different analysts may arrive at different intrinsic values for the same asset based on their assumptions and estimates.

Uncertainty: The future is uncertain, and any forecasted cash flows are based on assumptions that may not hold true. Unexpected changes in the economy, industry conditions, or company performance can cause the actual value to deviate significantly from the estimated intrinsic value.

Complexity: Calculating intrinsic value, especially for stocks and options, can be complex, requiring access to detailed financial data and forecasting skills. Investors need to be cautious when making assumptions that drive the calculation.

Conclusion

Intrinsic value is a vital concept in the world of investing, offering a deeper understanding of an asset's true worth beyond its current market price. By assessing intrinsic value, investors can make more informed decisions, identifying undervalued opportunities and avoiding overpriced assets. Whether applied to stocks, bonds, or options, intrinsic value serves as a foundation for value investing strategies, helping investors stay focused on long-term potential rather than short-term market fluctuations. However, due to its reliance on forecasts and assumptions, intrinsic value calculations should be approached with caution and supplemented with a broader analysis of the asset and market conditions.