Internal Rate of Return (IRR)

Internal Rate of Return (IRR): A Comprehensive Overview

The Internal Rate of Return (IRr) is a critical concept in finance and investing, primarily used to evaluate the profitability of potential investments or projects. It is a percentage that reflects the rate of return at which the net present value (NPV) of a series of cash flows (both incoming and outgoing) equals zero. Essentially, IRR is the discount rate that makes the sum of the present value of future cash flows equal to the initial investment, serving as a vital tool for assessing the attractiveness of investments.

IRR is widely used by companies, investors, and financial analysts to compare and rank different investment opportunities, allowing for a more informed decision-making process. It is especially valuable for evaluating long-term projects or investments with multiple cash inflows over time. When comparing different investment options, the project or investment with the highest IRR is often considered the most desirable, assuming all other factors are equal.

How IRR Works

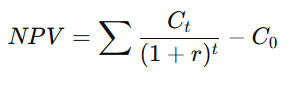

The formula for calculating IRR is rooted in the concept of Net Present Value (NPV), which is the present value of future cash flows minus the initial investment. The NPV formula is as follows:

Where:

C_t = Cash flow at time t

r = Discount rate (IRR, when NPV = 0)

t = Time period

C_0 = Initial investment

For IRR specifically, the goal is to find the rate rr at which the NPV equals zero. This means the sum of discounted future cash flows is equal to the initial investment, indicating that the project or investment breaks even.

Because this calculation involves finding a rate that makes the NPV zero, it often requires the use of trial and error or computational methods, such as Excel's IRR function or specialized financial software.

Interpreting IRR

Decision-Making Tool: IRR provides a clear and straightforward benchmark for investment decisions. If the IRR exceeds the required rate of return (or the cost of capital), the investment is considered profitable. If it is lower than the required rate, the investment may not be worth pursuing.

Comparison with Cost of Capital: In corporate finance, IRR is often compared to the company’s cost of capital, which is the minimum return needed to justify an investment. If the IRR is higher than the cost of capital, the investment is expected to add value to the firm. Conversely, if the IRR is lower, the investment may decrease value.

Decision Rule:

Accept the project if the IRR is greater than the required rate of return or cost of capital.

Reject the project if the IRR is less than the required rate of return or cost of capital.

Advantages of IRR

Simplicity: One of the primary advantages of IRR is its simplicity and ease of use. It provides a single number that is intuitive and straightforward for decision-makers to interpret.

Time-Value of Money: IRR takes the time value of money into account, providing a more accurate reflection of the value of future cash flows compared to simple profit calculations.

Comparable Across Projects: IRR allows for easy comparison between different projects or investments, regardless of their size, by providing a rate of return percentage.

Objective Decision-Making: Since IRR represents a percentage, it offers an objective measure of profitability. This helps companies assess the relative attractiveness of various investment options.

Limitations of IRR

Multiple IRRs: One significant limitation of IRR occurs when there are unconventional cash flows, meaning cash inflows and outflows occur irregularly over time. In such cases, there may be more than one IRR, making it difficult to interpret the result. This is often referred to as the problem of multiple IRRs.

Reinvestment Assumption: IRR assumes that interim cash flows are reinvested at the same rate as the IRR itself. In reality, this assumption may not hold true, and the reinvestment rate may differ from the IRR, which can lead to inaccurate projections. The Modified Internal Rate of Return (MIRR) is often used as an alternative to address this issue, as it assumes that cash flows are reinvested at a specified rate rather than at the IRR.

Not Useful for Mutually Exclusive Projects: IRR is not always reliable when comparing mutually exclusive projects (projects that cannot both be undertaken). For example, if two projects require different levels of investment, the IRR may favor the project with a higher rate of return, even if the other project offers a higher overall profit.

Scale of Investment: IRR does not consider the scale of an investment. A small project with a high IRR may be less valuable in absolute terms than a larger project with a lower IRR. As a result, relying solely on IRR may lead to poor decision-making in situations where the size of the investment matters.

Overestimating Future Cash Flows: If the estimated future cash flows used to calculate IRR are overly optimistic, the IRR may be misleading. Cash flow projections are inherently uncertain, and overly optimistic estimates can result in an IRR that does not accurately reflect the investment’s true potential.

Applications of IRR

Capital Budgeting: In capital budgeting, IRR is used to evaluate investment projects, such as purchasing new equipment, expanding facilities, or launching new products. The goal is to determine whether the project will generate returns greater than the cost of capital.

Real Estate Investment: Investors often use IRR to assess the profitability of real estate investments. By considering rental income, potential property appreciation, and other cash flows, IRR helps investors decide whether a property is worth purchasing.

Venture Capital and Private Equity: IRR is particularly useful in venture capital and private equity, where investors look for high returns on their investments. IRR can help assess the potential profitability of startups or small businesses that might have significant growth potential but also carry higher risks.

Project Finance: IRR is also used in project finance, particularly for infrastructure projects like highways, bridges, or energy plants. These projects often have long-term cash flows, making IRR a useful tool for determining whether the future returns justify the initial investment.

How to Calculate IRR

To calculate IRR, you need to have an understanding of the expected future cash flows from an investment. These typically include both initial costs and future revenues or savings. The process involves finding the discount rate that makes the NPV of the project zero. Here's a simple step-by-step breakdown:

List all Cash Flows: Gather all the expected cash flows, including both inflows (e.g., revenue or savings) and outflows (e.g., initial investments or costs).

Use Financial Software or a Calculator: IRR is usually calculated using specialized financial calculators or software such as Microsoft Excel, which has an IRR function. In Excel, simply enter the cash flows and apply the IRR function to find the rate at which the NPV equals zero.

Test for the Rate: If you’re calculating IRR manually, you can use trial and error to test different discount rates, adjusting until you find the rate that results in a zero NPV.

Conclusion

The Internal Rate of Return (IRR) is an invaluable tool for evaluating the profitability of investments and projects. It provides a clear rate of return that can help individuals and companies make informed investment decisions. However, IRR has limitations, such as the potential for multiple IRRs and unrealistic reinvestment assumptions, which should be carefully considered when using it for decision-making. By understanding both the advantages and limitations, businesses can use IRR as one of many tools to assess the feasibility and profitability of various investment opportunities.