Amortization Schedule

Definition:

An amortization schedule is a detailed table that breaks down each payment of a loan into principal and interest components, showing the balance of the loan after each payment is made. The schedule is used to understand how the loan will be paid off over time, how interest is calculated, and how much of each payment reduces the outstanding loan balance.

Amortization schedules are typically used for installment loans (such as mortgages, car loans, or personal loans), where the borrower makes regular payments that are primarily interest-heavy in the early stages of the loan and gradually become more principal-heavy toward the end.

How an Amortization Schedule Works:

An amortization schedule will show:

Payment number: The sequential number of each payment.

Total payment: The fixed monthly payment amount.

Interest payment: The portion of the payment that goes toward interest.

Principal payment: The portion of the payment that reduces the outstanding loan balance.

Remaining balance: The amount left on the loan after the payment is made.

Over time, as the loan balance decreases, the interest portion of each payment decreases, and the principal portion increases, even though the total payment remains the same throughout the loan term.

Example of an Amortization Schedule (30-Year Mortgage):

Let's consider a mortgage loan example to illustrate the amortization schedule.

Loan Amount (Principal): $300,000

Interest Rate: 4% annually

Loan Term: 30 years (360 months)

Monthly Payment: $1,432.25

The first few months of the amortization schedule would look like this:

How to Calculate an Amortization Schedule:

To calculate an amortization schedule, we need to break down each payment into two parts:

Interest Payment: The interest portion for each period is calculated by multiplying the remaining loan balance by the monthly interest rate.

Formula:

Interest Payment = Remaining Balance × Monthly Interest Rate

Principal Payment: The principal portion is the remaining part of the monthly payment after subtracting the interest portion.

Formula:

Principal Payment = Total Monthly Payment − Interest Payment

Remaining Balance: The remaining loan balance is reduced by the principal payment after each payment.

Formula:

Remaining Balance = Previous Balance − Principal Payment

Formula to Calculate Monthly Payment:

The formula for calculating the monthly payment on an amortized loan is as follows:

M=P×(1+r)n−1r(1+r)n

Where:

M = Monthly payment

P = Loan principal (initial loan amount)

r = Monthly interest rate (annual rate divided by 12)

n = Total number of payments (loan term in months)

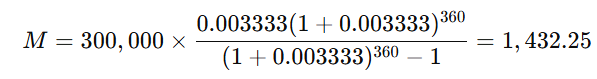

For our example with a loan amount of $300,000 at a 4% annual interest rate for 30 years:

P = $300,000

r = 4% / 12 = 0.003333

n = 30 × 12 = 360

Plugging into the formula:

M=300,000 × 0.003333(1+0.003333)^360 / (1+0.003333)^360 = 1,432.25

So, the monthly payment would be $1,432.25.

Why an Amortization Schedule is Important:

Predictability: An amortization schedule helps borrowers plan their finances, as it clearly shows the total monthly payment, the interest portion, and the principal portion of each payment.

Loan Transparency: It provides full transparency on how much of the monthly payment is going toward interest vs. principal, which is especially useful for long-term loans like mortgages.

Early Repayment: If a borrower wants to make extra payments to pay off the loan faster, an amortization schedule can help calculate how much earlier the loan can be paid off.

Interest Impact: By understanding the schedule, borrowers can see how much they are paying in interest over the life of the loan. This helps make informed decisions about whether refinancing or early repayment is a good option.

Early Repayment Impact:

If a borrower makes extra payments toward the principal (for example, $100 extra per month), the loan balance will decrease faster, reducing the amount of interest paid over the loan term and shortening the time to fully repay the loan.

Example: If the borrower in the earlier example makes an additional $100 monthly payment toward the principal, they will pay off the loan faster and save money on interest over time. The amortization schedule will reflect this change in the interest and principal breakdown.

Key Takeaways:

Amortization schedules provide a detailed breakdown of each loan payment and are used to track how much goes toward interest vs. principal.

Loan calculations include interest and principal portions, with the interest portion decreasing over time as the loan balance reduces.

Amortization schedules offer transparency, helping borrowers understand their payments and make informed decisions about refinancing or paying off the loan early.