Amortization

Definition:

Amortization is the process of gradually reducing a debt or the cost of an asset over time through regular payments. In finance, it refers to the repayment of a loan in equal installments, which cover both the principal amount (the original loan amount) and interest. In accounting, amortization refers to the process of spreading the cost of intangible assets (like patents, trademarks, and goodwill) over their useful life.

Example (Loan Amortization):

If you take out a $300,000 loan with a 30-year term at a 4% interest rate, your monthly payment will be a fixed amount that includes both principal and interest. In the early stages of the loan, a larger portion of your payment goes toward interest. Over time, more of your monthly payment goes toward reducing the principal balance.

Example:

Loan Amount: $300,000

Interest Rate: 4%

Term: 30 years (360 payments)

Monthly Payment: $1,432.25

For the first month, about $1,000 goes toward interest, and the remaining portion reduces the loan balance.

Example (Asset Amortization in Accounting):

Amortization is also used for intangible assets. For instance, if a company purchases a patent for $10,000 with a 5-year useful life, the company would amortize the patent by recognizing an annual amortization expense of $2,000.

Asset Cost: $10,000

Useful Life: 5 years

Amortization Expense per Year: $2,000

Each year, the company would reduce the book value of the patent by $2,000.

How Amortization Works in Loans:

For loans, amortization is done through an amortization schedule, which shows how each monthly payment is split between interest and principal. Early in the loan, a larger portion of the payment goes toward interest. As time progresses, more of the payment is applied to the principal.

Formula for Loan Amortization:

Where:

M = Monthly payment

P = Loan principal (the original loan amount)

r = Monthly interest rate (annual interest rate divided by 12)

n = Total number of payments (loan term in years multiplied by 12)

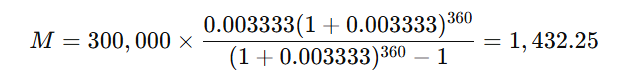

Example Loan Calculation:

For a loan of $300,000 with an interest rate of 4% over 30 years, the monthly payment can be calculated as:

P = $300,000

r = 4% / 12 = 0.003333

n = 30 × 12 = 360 payments

Using the formula:

So, the monthly payment would be approximately $1,432.25.

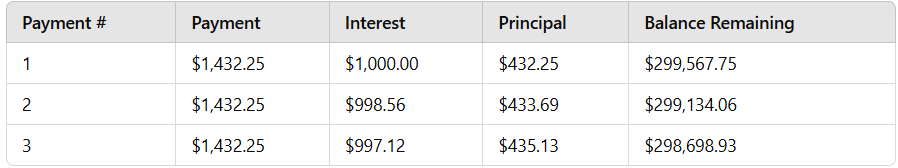

Amortization Schedule Example:

Here’s how the first few months of the loan repayment might look in an amortization schedule:

Amortization in Accounting for Intangible Assets:

Amortization is also used for intangible assets like patents, trademarks, and goodwill. This is different from depreciation, which applies to tangible assets.

For example, if a company purchases software for $10,000 with a useful life of 5 years, it would amortize the cost by recognizing an annual amortization expense of $2,000:

Asset Cost: $10,000

Useful Life: 5 years

Amortization Expense: $2,000 per year

Each year, the company would decrease the book value of the software by $2,000.

Why Amortization is Important:

For Loan Repayments: Amortization helps borrowers manage their finances by breaking down the cost of the loan into predictable, equal payments, ensuring the loan is fully paid off by the end of the term.

For Intangible Assets: Amortization allows businesses to spread out the cost of intangible assets over time, reflecting their usage and value loss, which also affects their tax obligations and financial statements.

Key Points to Remember:

Amortization applies to both loan repayment schedules (principal + interest) and the allocation of intangible asset costs in accounting.

For loans, amortization ensures you make regular, manageable payments and that the loan is paid off by the end of the term.

For intangible assets, amortization allows companies to allocate the cost of the asset over its useful life, impacting profits and taxes