Volume Weighted Average Price (VWAP)

Volume Weighted Average Price (VWAP): Understanding the Concept and Application

The Volume Weighted Average Price (VWAP) is a trading indicator that represents the average price of a security throughout a trading session, adjusted for its trading volume at each price level. It is commonly used by traders and institutional investors to assess market trends, determine fair value, and make informed decisions regarding trade execution. VWAP helps traders evaluate whether the current price is above or below the average price for the day, which can be a useful gauge for identifying entry or exit points.

Key Characteristics of VWAP

Volume-Weighted Average: VWAP is calculated by taking the sum of the dollar value of all trades (price multiplied by volume) over a specific time period and dividing it by the total volume of trades during that period. This gives more weight to prices where higher volumes of trades have occurred, making it more reflective of the actual market activity.

Timeframe: VWAP is typically calculated for a single trading day, starting from the opening bell and ending at market close. It is a dynamic indicator, meaning it updates in real-time as trading volumes and prices change.

Benchmark Indicator: VWAP is often used as a benchmark by institutional investors, such as mutual funds and hedge funds, to measure the efficiency of their trades. A trade executed at or near the VWAP is considered optimal, as it reflects a fair price based on market activity for the day.

Trend Confirmation: VWAP is used by traders to confirm the current trend. If the price is above the VWAP, it is generally considered a sign of upward momentum, while if the price is below the VWAP, it suggests a bearish trend.

How VWAP Is Calculated

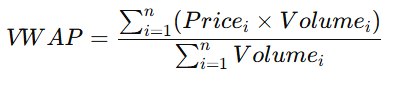

The formula for calculating VWAP is:

Where:

Price_i is the price of the security at each transaction point.

Volume_i is the trading volume at each transaction point.

n is the number of trades during the session.

VWAP is calculated cumulatively, meaning it is updated as each new trade occurs throughout the day. The VWAP for a given time point reflects all trades up until that time.

Applications of VWAP

Trade Execution Strategy: Traders, particularly institutional investors, use VWAP to guide their execution strategies. If an investor can buy below the VWAP or sell above it, it is often seen as a favorable trade. VWAP provides a benchmark that helps traders minimize market impact and avoid large slippage, which could occur if they buy or sell a large position without considering the average market price.

Market Sentiment Indicator: VWAP can also be used to gauge market sentiment. If the price is consistently above VWAP, it suggests strong buying pressure and potentially an uptrend. Conversely, if the price is below VWAP, it could signal bearish sentiment or selling pressure.

Support and Resistance Levels: Some traders use VWAP as a dynamic support or resistance level. Prices often tend to bounce off the VWAP or reverse direction when approaching it, making it a useful tool for technical analysis.

Performance Evaluation: Institutional investors and traders often measure their performance relative to VWAP. For example, if a large order is executed at a price higher than the VWAP, it may be seen as a poor execution. If the order is executed below the VWAP, it is generally considered a better result, indicating the investor bought at a more favorable price.

Advantages of VWAP

Volume Sensitivity: Because VWAP gives more weight to trades with higher volume, it provides a better representation of the true price at which most market participants are transacting. This makes it more reliable than simple moving averages, which do not account for volume.

Fair Price Benchmark: VWAP is an objective benchmark for traders to determine whether they are buying or selling at a fair price, which is crucial in minimizing trading costs.

Widely Used: Since VWAP is widely used across financial markets, it is a common reference point for other traders and investors, making it an important indicator for identifying market trends and setting strategies.

Helps in Minimizing Slippage: By aiming to execute trades around the VWAP, traders can reduce the impact of their own transactions on the market, preventing large price movements and minimizing slippage, especially for large orders.

Disadvantages of VWAP

Not Suitable for All Market Conditions: While VWAP is useful in trending markets, it may not be as effective in sideways or choppy markets where price action is erratic. In such conditions, price movements may frequently cross the VWAP, leading to false signals.

Lagging Indicator: As VWAP is a cumulative average, it lags the market price, especially during periods of high volatility. This means VWAP may not always reflect the most current price action, which can limit its use for intraday timing.

Calculation Dependent on Volume: Since VWAP is weighted by volume, the indicator can sometimes be skewed by large trades that take place at specific price levels. In some cases, this can make the VWAP less representative of the broader market sentiment.

Conclusion

The Volume Weighted Average Price (VWAP) is a powerful tool used by traders and institutional investors to assess fair value and guide trade execution strategies. Its volume-sensitive nature makes it a more accurate reflection of the actual price at which a security is being traded compared to simple price averages. While VWAP is helpful in many trading scenarios, it is important to understand its limitations and apply it in appropriate market conditions for maximum effectiveness.