Variance

Variance: Understanding its Role in Finance and Investment Analysis

Variance is a statistical measure used to assess the dispersion or spread of a set of data points. In the context of finance and investing, variance plays a crucial role in risk analysis, portfolio management, and understanding the volatility of an asset or portfolio.

What is Variance?

Variance measures the extent to which individual data points in a dataset differ from the mean (average) of that dataset. A high variance indicates that the data points are spread out over a wider range, while a low variance suggests that the data points are closer to the mean.

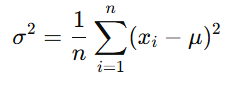

Mathematically, variance is calculated as the average of the squared differences from the mean. For a dataset of values, x1,x2,…,xnx_1, x_2, \dots, x_n, with a mean value μ\mu, the variance σ2\sigma^2 is given by the formula:

Where:

σ2\sigma^2 is the variance,

nn is the number of data points,

xix_i is each data point, and

μ\mu is the mean of the data points.

Variance in Finance

In finance, variance is primarily used to measure the volatility or risk of an asset, a portfolio, or a financial return series. The greater the variance in the returns of an asset, the more volatile it is, meaning there is more uncertainty regarding its future performance. Here’s how variance is typically applied in finance:

Risk and Volatility:

In the context of investing, variance is a key measure of volatility, which is the degree to which an asset's price fluctuates over time. A high variance suggests a high level of uncertainty about an asset's price movements, while a low variance suggests a more stable or predictable asset.

Standard deviation, which is the square root of variance, is often used alongside variance to make risk comparisons across different assets or portfolios. Since variance gives a larger weight to extreme values due to the squaring of differences, standard deviation offers a more intuitive measure of risk in the same units as the data.

Portfolio Management:

In portfolio theory, variance is used to assess the risk of a portfolio's returns. Portfolio managers seek to minimize the overall variance of a portfolio by combining assets with different variances and correlations.

Modern Portfolio Theory (MPT) suggests that diversification across assets with low or negative correlations can reduce the overall portfolio variance, thus minimizing risk.

The total portfolio variance is influenced not only by the individual variances of the assets in the portfolio but also by the covariance between the returns of the assets. Therefore, the correlation between asset returns plays a critical role in the portfolio’s overall risk.

Return Analysis:

Variance is often used to assess the performance and risk profile of a specific asset or an investment portfolio. A higher variance in the return of an asset can indicate higher risk, and investors may use this to determine whether the risk level is acceptable for their investment strategy.

Investment strategies that focus on maximizing returns while minimizing variance (risk) are generally viewed as more optimal, as they aim to achieve higher returns without exposing the investor to excessive risk.

Cost of Capital:

Variance plays an essential role in determining the cost of capital, which is the expected return required by investors based on the risk associated with an investment. A higher variance in returns generally implies a higher level of risk, which, in turn, increases the required rate of return (or cost of capital) for investors to compensate for that risk.

Variance in Comparison to Other Measures

Standard Deviation:

The standard deviation is simply the square root of variance. It is often preferred over variance because it is expressed in the same units as the data (such as dollars or percentage points), making it easier to interpret. While variance can be used in mathematical models, standard deviation provides a more practical measure of risk for investors.

Mean Absolute Deviation (MAD):

Another measure that is sometimes compared to variance is the mean absolute deviation. While variance squares the differences between the data points and the mean, MAD simply calculates the average of the absolute differences. Some analysts prefer MAD because it does not overemphasize extreme outliers, which can distort variance.

Beta:

Beta is another measure used to assess risk, but unlike variance, which measures the total volatility of an asset, beta measures an asset’s volatility relative to the broader market (or a benchmark index). A beta of 1 implies the asset moves in line with the market, while a beta greater than 1 means the asset is more volatile than the market, and a beta less than 1 indicates it is less volatile.

Applications of Variance in Financial Decision-Making

Portfolio Optimization:

Investors use variance to determine the optimal mix of assets that minimizes portfolio risk while achieving desired returns. By carefully selecting assets with lower or negative correlation, investors can create a diversified portfolio with lower overall variance.

Asset Allocation:

In determining the appropriate mix of asset classes (such as stocks, bonds, and real estate), variance is used to assess the riskiness of each asset class. A diversified portfolio will have assets with differing risk profiles, and the allocation is adjusted based on their individual variances and correlations to reduce the overall portfolio risk.

Risk Management:

Variance is a key tool in risk management. Investors, traders, and financial institutions use variance to evaluate the potential risk of price fluctuations in assets and to develop strategies for managing that risk, such as hedging or diversification.

Performance Evaluation:

Variance can be used to compare the risk-adjusted performance of different investments or strategies. The Sharpe ratio, for example, is calculated by dividing the excess return of an asset by its standard deviation (which is the square root of variance). This ratio helps investors assess whether the return of an asset justifies its level of risk.

Limitations of Variance

While variance is a useful measure of risk, it has some limitations:

Sensitivity to Outliers: Variance gives disproportionate weight to outliers, as it squares the differences from the mean. Large deviations can inflate the variance, even if they are rare.

Non-Normal Distributions: Variance assumes that returns follow a normal distribution, but many financial returns exhibit skewness or kurtosis (fat tails), which can make variance less effective in describing the full risk profile of assets with non-normal distributions.

Conclusion

Variance is a critical concept in finance, used to measure the risk or volatility of an asset or portfolio. By assessing how much individual returns deviate from the average, variance helps investors understand the degree of uncertainty or potential risk they face. While variance provides valuable insights, it is often used in combination with other metrics, such as standard deviation or beta, to get a more comprehensive view of risk.