SEP IRA (Simplified Employee Pension Individual Retirement Account)

Definition:

A SEP IRA is a retirement savings plan designed for self-employed individuals and small business owners, allowing employers to contribute to their employees' retirement savings, including their own. Contributions are made directly to an IRA established for each employee, and the employer receives tax deductions for the contributions. SEP IRAs are governed by simple rules, making them an attractive option for businesses seeking an easy-to-administer retirement plan.

Key Features of a SEP IRA:

Employer Contributions Only:

Only employers contribute to the SEP IRA accounts. Employees do not contribute, unlike in a 401(k) or traditional IRA.Flexible Contributions:

Employers decide the amount to contribute each year, with no requirement to contribute annually. This flexibility helps in managing cash flow variability.Contribution Limits:

For 2024, employers can contribute up to 25% of an employee's compensation or $66,000, whichever is less. Contributions are capped at the employee's first $330,000 of compensation.Tax Benefits:

Contributions are tax-deductible for the employer, and employees do not pay taxes on the contributions until they withdraw funds in retirement.Eligibility Requirements:

Employers can set eligibility rules, but generally, employees must:Be at least 21 years old.

Have worked for the employer for at least three of the past five years.

Earn at least $750 (2024 threshold) during the year.

Investment Options:

Contributions are invested in the same way as a traditional IRA, with options including stocks, bonds, mutual funds, and ETFs.

Example of How a SEP IRA Works:

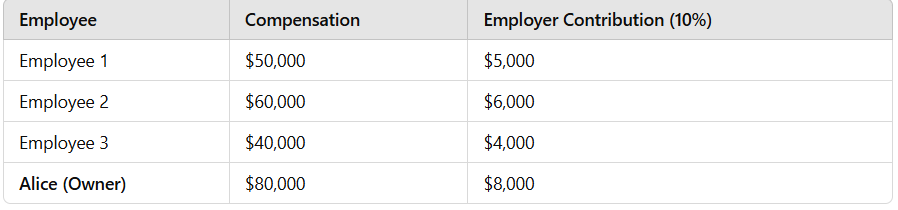

Imagine a small business owner named Alice who has three employees and also earns income from her business. Here’s how Alice could set up and contribute to a SEP IRA:

Setup: Alice establishes SEP IRA accounts for herself and her employees through a financial institution.

Contribution Decision: Alice decides to contribute 10% of each employee's compensation to their SEP IRAs.

In total, Alice contributes $23,000 to the SEP IRA accounts, which she can deduct from her taxable income.

Advantages of a SEP IRA:

Simplicity:

SEP IRAs are easy to establish and maintain, with minimal paperwork and administrative costs compared to plans like 401(k)s.High Contribution Limits:

SEP IRAs allow for much higher contribution limits than traditional or Roth IRAs, making them ideal for maximizing retirement savings.Flexibility:

Employers can adjust contribution amounts based on their business’s profitability each year.Tax Benefits:

Contributions are tax-deductible, reducing the employer’s taxable income. Employees benefit from tax-deferred growth on contributions.

Disadvantages of a SEP IRA:

Employer-Only Contributions:

Employees cannot contribute to the SEP IRA, which may limit their ability to boost retirement savings independently.Equal Contributions:

Employers must contribute the same percentage of compensation for all eligible employees, which can be costly for businesses with many employees.Required Minimum Distributions (RMDs):

Like traditional IRAs, SEP IRAs are subject to RMDs starting at age 73.

Withdrawal Rules:

Early Withdrawal Penalty:

Withdrawals before age 59½ are subject to a 10% penalty plus income tax, except for specific circumstances like disability or medical expenses.Taxation of Withdrawals:

Distributions are taxed as ordinary income.

Conclusion:

A SEP IRA is an excellent option for self-employed individuals and small business owners seeking a straightforward and tax-advantaged retirement savings plan. Its high contribution limits, ease of administration, and flexibility make it a practical choice, especially for businesses without employees or with only a few employees. However, employers should carefully consider the costs of providing equal contributions to all eligible employees and the lack of employee contribution options when choosing a SEP IRA.