Interest Rate Parity

Interest Rate Parity (IRP): A Comprehensive Definition

Interest Rate Parity (IRP) is a fundamental concept in international finance that explains the relationship between exchange rates and interest rates in two different countries. The theory states that the difference in interest rates between two countries should be equal to the difference between the spot exchange rate and the forward exchange rate. In simpler terms, interest rate parity ensures that investors do not earn a risk-free profit by exploiting differences in interest rates between countries.

The principle of IRP arises from the idea that capital should flow freely across borders, and any differences in interest rates between countries would otherwise lead to arbitrage opportunities (risk-free profits). These opportunities would drive the exchange rates to adjust, making the potential for risk-free profits disappear. Thus, IRP helps to ensure that currency exchange rates move in such a way that the return on investments in different currencies, after accounting for exchange rate changes, remains equivalent when interest rate differentials are considered.

Key Components of Interest Rate Parity

Spot Exchange Rate:

The spot exchange rate is the current exchange rate for immediate settlement of currency transactions. It is the price at which one currency can be exchanged for another in the foreign exchange market at a given moment.

Forward Exchange Rate:

The forward exchange rate is the agreed-upon exchange rate for a currency transaction that will take place at a future date (e.g., one month, six months, etc.). This rate is set today but is based on the expectations of future exchange rates.

Interest Rates:

The interest rate in a country is the return on investment for financial instruments like bonds, savings accounts, or certificates of deposit. The difference in interest rates between two countries is central to IRP.

Arbitrage:

Arbitrage is the practice of exploiting price differences between markets for a risk-free profit. In the context of IRP, arbitrage opportunities would arise if the forward exchange rate and the spot exchange rate do not reflect the interest rate differentials between two countries.

The Interest Rate Parity Formula

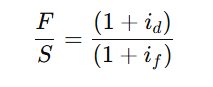

The relationship described by interest rate parity can be expressed using the following formula:

Where:

F is the forward exchange rate (the exchange rate agreed upon today for a future date).

S is the spot exchange rate (the current exchange rate).

i_d is the domestic interest rate (interest rate in the home country).

i_f is the foreign interest rate (interest rate in the foreign country).

This formula shows that the forward exchange rate (F) should adjust in such a way that the difference in interest rates between the domestic country (i_d) and the foreign country (i_f) is offset. If the domestic interest rate is higher than the foreign interest rate, the domestic currency will trade at a premium in the forward market (i.e., it will be more expensive to buy in the future). Conversely, if the foreign interest rate is higher, the domestic currency will trade at a discount.

Types of Interest Rate Parity

There are two main versions of IRP:

Covered Interest Rate Parity (CIRP):

Covered IRP assumes that there are no barriers to capital flows and that the forward market is fully hedged. In this case, arbitrageurs can cover their positions against currency risk using the forward contract. Covered IRP holds when the forward exchange rate is set to eliminate any potential for arbitrage.

Example: If an investor in the U.S. wants to invest in a foreign bond, they can use a forward contract to hedge against future exchange rate risk. The difference in interest rates between the U.S. and the foreign country will dictate the forward exchange rate needed to avoid arbitrage.

Uncovered Interest Rate Parity (UIRP):

Uncovered IRP, on the other hand, does not involve hedging with forward contracts. This form of IRP assumes that the investor is exposed to exchange rate risk and does not take any actions to offset that risk. UIRP implies that the expected future spot exchange rate will adjust to offset interest rate differentials between countries.

Example: If an investor expects the currency in the foreign country to appreciate based on the interest rate differential, they may choose to invest in foreign assets without hedging, betting that the exchange rate will move in their favor.

Practical Implications of Interest Rate Parity

Exchange Rate Movements:

According to IRP, interest rate differentials between countries should predict future movements in exchange rates. If a country’s interest rates are higher than another’s, its currency should depreciate in the future, and vice versa. This is because higher interest rates attract foreign capital, which increases demand for that currency, thereby influencing future exchange rates.

Arbitrage and Capital Flows:

The concept of IRP assumes that investors are rational and will engage in arbitrage if they see a mismatch between interest rates and exchange rates. For example, if a country offers higher interest rates, investors will borrow in the lower-rate currency, exchange it for the higher-rate currency, and invest in assets that yield the higher return. This flow of capital will force the exchange rate to adjust, bringing it back into parity.

Inflation Expectations:

Interest rate parity can also be influenced by inflation expectations. A country with higher inflation will often have higher interest rates to compensate for the loss of purchasing power. If inflation is expected to rise in the future, IRP suggests that the currency of the country with higher inflation will depreciate in the future.

Impact of Central Bank Policies:

Central banks play a significant role in determining interest rates through monetary policy. If a central bank raises interest rates, it can make that country’s assets more attractive to foreign investors, increasing demand for its currency and affecting the forward exchange rate.

Assumptions of Interest Rate Parity

Perfect Capital Mobility:

IRP assumes that capital flows freely between countries without restrictions, such as capital controls or transaction costs, which could limit the ability of investors to engage in arbitrage.

No Transaction Costs:

The model assumes there are no transaction costs, taxes, or other barriers that could prevent investors from taking advantage of interest rate differentials between countries.

Risk-Free Capital:

IRP assumes that investors can invest in risk-free instruments, such as government bonds, in both countries. In reality, however, investors may face risks, such as currency risk, credit risk, and political risk, which could influence their decisions.

Real-World Considerations

While interest rate parity provides a useful theoretical framework for understanding the relationship between interest rates and exchange rates, several real-world factors can cause deviations from perfect parity:

Capital Controls:

Some countries impose restrictions on the movement of capital in and out of the country, which can prevent the free flow of investment and cause deviations from IRP.

Transaction Costs:

In practice, transaction costs (such as bid-ask spreads, broker fees, and taxes) can make arbitrage opportunities less profitable or inaccessible.

Political Risk:

Political instability, changes in government, or the threat of currency controls can disrupt the flow of capital and cause deviations from the expected relationship between interest rates and exchange rates.

Currency Speculation:

Uncovered interest rate parity assumes that investors are rational, but in reality, currency speculators may drive exchange rates in ways that do not align with the fundamental predictions of IRP, especially if they are betting on future movements in exchange rates.

Conclusion

Interest Rate Parity (IRP) is a key concept in international finance that explains the relationship between interest rates and exchange rates. It provides a framework for understanding how differences in interest rates between countries influence the forward exchange rates and capital flows. The theory of IRP is essential for understanding the behavior of currency markets, exchange rate forecasting, and the potential for arbitrage. While real-world factors may cause deviations from perfect parity, IRP remains a crucial tool for financial analysts and investors involved in international markets.