Interest

Interest: An In-Depth Guide

Interest is the cost of borrowing money or the return on investment earned on savings or investments. It is typically expressed as a percentage of the principal amount, which is the initial sum of money either borrowed or invested. Interest can be understood as the price paid for the use of someone else’s money or the compensation earned for providing capital. It plays a central role in the world of finance, affecting individuals, businesses, and governments alike. The concept of interest is prevalent in both lending and investing scenarios, and it can vary widely based on several factors, including the type of interest (simple or compound), the time frame, the risk level, and the prevailing economic conditions.

Understanding Interest

Interest is generally categorized into two types:

Simple Interest: Simple interest is calculated on the principal amount alone. It does not take into account the interest that accumulates on the previous periods' interest. The formula for simple interest is:

I = P × r × t

Where:

I is the interest,

P is the principal amount,

r is the annual interest rate (expressed as a decimal),

t is the time the money is borrowed or invested for (in years).

For example, if you invest $1,000 at a 5% simple annual interest rate for 3 years, the total interest earned would be:

I=1000×0.05×3=150

The total interest earned is $150, and the total amount (principal + interest) after 3 years would be $1,150.

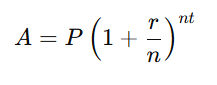

Compound Interest: Compound interest, on the other hand, is calculated on the principal amount as well as the interest that has been added to it. Over time, the interest earns its own interest, which makes compound interest a more powerful tool for growing wealth. The formula for compound interest is:

Where:

A is the final amount (principal + interest),

P is the principal amount,

r is the annual interest rate (expressed as a decimal),

n is the number of times the interest is compounded per year,

t is the time the money is invested or borrowed for (in years).

Compound interest is calculated by applying interest to both the principal and accumulated interest, and it can result in significantly larger returns over time compared to simple interest.

Types of Interest

Nominal Interest Rate: The nominal interest rate is the rate that is stated or advertised by financial institutions. It does not account for the compounding frequency, and as a result, it can be misleading when comparing different financial products.

Real Interest Rate: The real interest rate takes into account the effects of inflation on the purchasing power of money. It reflects the true return on an investment or the actual cost of borrowing when adjusted for inflation. The formula for the real interest rate is:

Real Interest Rate=Nominal Interest Rate−Inflation Rate

For instance, if the nominal interest rate is 6% and inflation is 2%, the real interest rate is 4%. Real interest rates are important for assessing the true value of money over time.

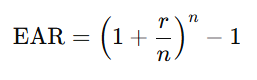

Effective Annual Rate (EAR): The effective annual rate (EAR), also known as the annual equivalent rate (AER), represents the annual rate of return taking into account the effect of compounding over a given period. It is especially useful when comparing interest rates that are compounded at different frequencies. The formula for EAR is:

Where:

r is the nominal interest rate,

n is the number of compounding periods per year.

EAR helps investors and borrowers understand how compounding affects their investments or loans over time.

Interest in Borrowing: How Lenders Earn Money

In the context of borrowing, interest is the payment made by the borrower to the lender for the use of borrowed money. It represents the cost of obtaining funds and compensates the lender for taking on the risk associated with lending. Borrowers typically repay the principal amount in addition to interest over the life of the loan. Interest is commonly charged on loans such as mortgages, personal loans, car loans, and business loans.

Fixed Interest Rates: A fixed interest rate remains constant throughout the life of the loan. The advantage of fixed rates is predictability, as borrowers know exactly how much they will pay in interest over the life of the loan. For example, a 5% fixed-rate mortgage means that the interest rate will stay the same for the entire term of the mortgage.

Variable or Adjustable Interest Rates: A variable interest rate, or adjustable-rate, changes over time based on market conditions or other underlying factors. This means that the interest rate can go up or down, affecting the borrower’s monthly payments. While variable rates may start lower than fixed rates, they come with more uncertainty and the potential for higher costs in the future.

APR (Annual Percentage Rate): The APR is the total cost of borrowing expressed as an annual rate, which includes both the interest rate and any fees associated with the loan. It provides a more comprehensive view of the cost of borrowing than the nominal interest rate alone. The APR is commonly used for mortgages, credit cards, and personal loans to help consumers compare different borrowing options.

Interest in Investing: How Investors Earn Money

On the investment side, interest is the return an investor receives on their investment, typically in the form of interest payments on bonds, savings accounts, or other fixed-income securities. Investors seek out interest-bearing investments to generate income and preserve their capital. Interest income can be earned through a variety of instruments:

Bonds: When an investor purchases a bond, they are essentially lending money to a government, corporation, or other entity in exchange for periodic interest payments, known as coupon payments. The bond issuer agrees to repay the principal (face value) of the bond at a set maturity date, in addition to the interest.

Certificates of Deposit (CDs): A CD is a time deposit offered by banks and credit unions that pays interest over a fixed period of time. The investor agrees to leave their money in the CD for a specific term, after which they can access the principal along with the earned interest. CD rates tend to be higher than those of regular savings accounts due to the fixed term commitment.

Savings Accounts: Savings accounts are deposit accounts offered by banks that pay interest on the deposited funds. While interest rates on savings accounts are typically lower than bonds or CDs, they provide easy access to funds and are generally considered low-risk.

Factors Affecting Interest Rates

Interest rates are influenced by a wide range of factors, including:

Central Bank Policy: Central banks, such as the U.S. Federal Reserve or the European Central Bank, play a significant role in setting interest rates through monetary policy. By adjusting the benchmark interest rates, central banks influence borrowing costs for consumers and businesses, which in turn affects the broader economy.

Inflation: Inflation has a direct impact on interest rates. When inflation is high, lenders demand higher interest rates to compensate for the reduced purchasing power of the money they lend. Conversely, during periods of low inflation, interest rates tend to be lower.

Economic Conditions: In times of economic growth, interest rates may rise as demand for credit increases. Conversely, during economic slowdowns or recessions, central banks may lower interest rates to stimulate borrowing and investment.

Risk and Creditworthiness: Lenders assess the risk of lending to an individual or entity before determining the interest rate. Borrowers with higher creditworthiness are typically offered lower interest rates, while riskier borrowers (e.g., those with poor credit scores) face higher rates to compensate for the increased risk.

Interest in Personal Finance

Interest impacts personal finances in a variety of ways, from the cost of borrowing to the growth of savings. It’s crucial for individuals to understand the difference between the types of interest they may encounter and how they can use this knowledge to make more informed financial decisions. For instance:

Paying off Debt: High-interest debt, such as credit card balances, can quickly become expensive. By prioritizing debt with higher interest rates, individuals can reduce the total interest paid over time.

Saving and Investing: Understanding interest and compounding can help individuals grow their savings more effectively. By choosing higher-yielding accounts or investments, individuals can earn more on their deposits over time.

Conclusion

Interest is a fundamental concept in finance, affecting both borrowing and investing decisions. Whether it’s the cost of borrowing money, the return on investments, or the impact of interest rates on the broader economy, interest plays a central role in shaping financial outcomes. By understanding how interest works and the factors that influence it, individuals and businesses can make better financial decisions and optimize their money management strategies. Whether dealing with loans, investments, or savings, mastering the concept of interest is key to long-term financial success.