Incremental Cost

Incremental Cost: A Comprehensive Overview

Incremental cost, often referred to as marginal cost, is a key concept in financial and managerial accounting that refers to the additional cost incurred when producing one more unit of a good or service. It represents the change in total cost when the level of output is increased by one unit, and it is an essential metric for making decisions regarding production, pricing, and resource allocation. Understanding incremental cost helps businesses determine the financial impact of increasing or decreasing their production levels, enabling them to optimize their operations and maximize profits.

Definition of Incremental Cost

In simple terms, incremental cost is the cost incurred when a company increases its production of goods or services by a specific amount. This cost includes both variable costs, which change with production levels, and fixed costs, which remain constant up to a certain level of production capacity.

While fixed costs (such as rent and salaries) do not change in the short term, variable costs (such as materials and labor) increase or decrease depending on the quantity of goods or services produced. Incremental cost is an essential figure when making decisions such as whether to expand production, launch a new product line, or enter a new market.

Formula for Incremental Cost

The formula for calculating incremental cost is:

Incremental Cost = Change in Total Cost / Change in Quantity of Output

Where:

Change in Total Cost refers to the difference in total cost when increasing production by a certain amount.

Change in Quantity of Output refers to the change in the number of units produced.

For example, if a company increases its output by 100 units and the total cost of production increases by $1,000, then the incremental cost per unit would be:

Incremental Cost = $1,000 / 100 =$10 per unit

Types of Costs Involved

Incremental cost consists primarily of variable costs, but it can also include fixed costs if production increases beyond a certain threshold that necessitates additional fixed capacity. Here’s a closer look at both:

1. Variable Costs

Variable costs are those that change in direct proportion to the level of production or output. These costs include:

Raw materials: The cost of materials used to make the product.

Direct labor: Wages paid to workers who are directly involved in production.

Utilities: Costs for electricity, water, and other utilities that vary with production.

For example, if a factory produces 1,000 units of a product at a cost of $5,000 for raw materials, and the cost increases by $1,000 when production is raised to 1,100 units, the increase in variable cost is $1,000.

2. Fixed Costs

Fixed costs are those that remain constant regardless of the level of output within a certain range of production. However, if production increases beyond a certain point, fixed costs can increase. These include:

Rent: Monthly payments for the use of factory or office space.

Salaries of management: Salaries paid to non-production employees, such as managers or administrative staff.

Depreciation: The reduction in value of fixed assets like machinery and buildings.

For example, a company may have to invest in additional machinery or hire more managerial staff to support an increase in production. These costs would be considered incremental fixed costs.

Importance of Incremental Cost in Decision-Making

Understanding incremental costs is crucial for businesses, particularly when making decisions that involve scaling production, introducing new products, or setting prices. Here’s how incremental cost plays a role in various business decisions:

1. Pricing Decisions

One of the primary uses of incremental cost is in pricing strategy. When setting the price of a product or service, businesses must consider not only the total cost but also the incremental cost of producing additional units. If the incremental cost is higher than the selling price, the company may lose money on each additional unit sold. Conversely, if the incremental cost is lower than the selling price, the company can achieve profitability and maximize profits by increasing production.

2. Production Decisions

When deciding whether to increase production or capacity, businesses must evaluate the incremental cost of producing additional units. If the incremental cost of producing one more unit is lower than the revenue that would be earned from selling that unit, then increasing production is a profitable decision. However, if the incremental cost is higher than the revenue, it might be better to halt production or seek ways to reduce costs.

3. Cost Control

Incremental cost helps businesses identify areas where they can optimize costs. For instance, if a company finds that the incremental cost of increasing production has risen significantly, it might investigate the reasons for the cost increase (such as higher labor costs or inefficient processes) and take steps to improve efficiency.

4. Outsourcing Decisions

Incremental cost analysis also plays a critical role when deciding whether to outsource a process or keep it in-house. By comparing the incremental cost of producing a good internally to the cost of purchasing it from an external supplier, businesses can determine which option is more cost-effective. If the incremental cost of producing the good internally is lower, then it makes sense to continue production in-house. If the external supplier offers a lower cost, then outsourcing may be the better option.

5. Investment Decisions

In capital budgeting, incremental cost is used to evaluate the potential profitability of new investments. When a company considers expanding its production capacity or introducing new products, it must evaluate the incremental costs associated with these investments. This helps to determine whether the expected returns from the investment justify the additional costs.

Incremental Cost vs. Marginal Cost

While incremental cost and marginal cost are often used interchangeably, they do have subtle differences in certain contexts.

Marginal cost refers to the cost of producing one additional unit of output, whereas incremental cost refers to the additional cost incurred when producing a certain number of additional units.

Marginal cost is a more precise measurement of cost at the unit level, while incremental cost typically applies to a range of output increases.

In most practical applications, particularly for decision-making in production, the two terms can be used interchangeably, but understanding the context is important.

Real-World Example of Incremental Cost

Let’s consider a real-world example of incremental cost. Imagine a company that manufactures custom t-shirts. The company’s fixed costs are $10,000 per month, which cover rent, salaries, and depreciation on equipment. The variable costs for each t-shirt produced include $5 for materials and $3 for labor.

Scenario 1: Producing 1,000 t-shirts:

Total fixed costs: $10,000

Total variable costs: $5 x 1,000 = $5,000

Total cost: $10,000 + $5,000 = $15,000

Scenario 2: Producing 1,200 t-shirts:

Total fixed costs: $10,000

Total variable costs: $5 x 1,200 = $6,000

Total cost: $10,000 + $6,000 = $16,000

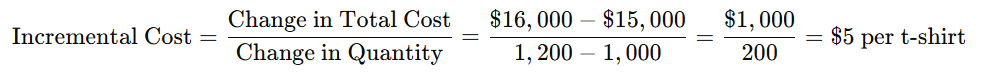

The incremental cost of producing 200 additional t-shirts (from 1,000 to 1,200) is the increase in total cost divided by the increase in quantity produced:

This indicates that the additional cost of producing each of the next 200 t-shirts is $5.

Conclusion

Incremental cost is a crucial concept in business, helping managers and financial analysts make informed decisions about production, pricing, and resource allocation. By understanding the additional costs involved in increasing production, businesses can optimize their operations, maximize profitability, and make more effective strategic decisions. Whether for scaling production, setting prices, or evaluating new investment opportunities, knowing how to calculate and interpret incremental costs can significantly enhance the decision-making process.