Implied Interest Rate

Implied Interest Rate: A Comprehensive Overview

The Implied Interest Rate is the rate of return that can be inferred from the relationship between the price of a financial instrument, such as a bond, loan, or annuity, and the cash flows it generates. This rate is typically used in situations where the actual interest rate is not explicitly stated but can be calculated from the known price or value of the instrument and its future cash flows. The implied interest rate reflects the yield or discount rate that equates the present value of future cash flows to the current market price of the instrument.

In other words, it is the rate of return implied by the market price of an asset, considering the expected payments or returns over time. The implied interest rate is used by investors and financial analysts to assess the attractiveness of various financial products and to compare different investment opportunities.

How the Implied Interest Rate Works

The implied interest rate is commonly calculated using the concept of present value and future value in time value of money calculations. For instance, if an investor is purchasing a bond, the implied interest rate would be the discount rate that makes the present value of the bond’s future coupon payments and face value equal to its current price.

Let’s break this down with a simple example:

Bond Example:

Assume a bond pays a coupon of $50 annually for 5 years and has a face value of $1,000. If the current price of the bond is $950, the implied interest rate is the rate that makes the present value of the $50 annual payments and the $1,000 face value (which will be paid at the end of 5 years) equal to $950.

The calculation involves solving for the interest rate (yield to maturity or YTM) that discounts these future cash flows to the present value of the bond. This can be done using financial calculators or Excel functions like the

YIELDfunction, or by solving the equation using trial and error.

Loan Example:

For a loan, the implied interest rate can be determined by looking at the loan's payments and the principal. If a borrower takes out a loan of $10,000, and makes monthly payments of $200 for 5 years, the implied interest rate is the rate that equates the total payments made to the present value of the loan amount.

Applications of Implied Interest Rate

The concept of implied interest rates is broadly applied across various areas of finance, such as:

Bonds:

The implied interest rate for a bond is often referred to as its yield to maturity (YTM). This is the annualized return an investor can expect to earn if the bond is held until maturity, assuming all coupon payments are made as scheduled. The YTM is particularly important when comparing bonds with different prices, maturities, and coupon rates.

Loans and Mortgages:

For loans, the implied interest rate helps determine the cost of borrowing. When a borrower takes out a loan, they typically know the amount they will borrow and the payment terms. The implied interest rate helps calculate the cost of the loan over its life by accounting for the interest payments in relation to the principal amount.

Annuities:

In the case of an annuity, the implied interest rate refers to the rate that would make the present value of the annuity’s future payments equal to its price. For instance, if someone buys an annuity for $100,000 that will pay $5,000 annually for 30 years, the implied interest rate is the rate that equates these future payments to the initial $100,000 investment.

Options and Derivatives:

The implied interest rate can also be used to understand the pricing of options and derivatives. In particular, implied interest rates are a component in models like the Black-Scholes model, which is used to price options and other derivatives. These models use implied interest rates to reflect the opportunity cost of capital or the rate at which an investor could earn a risk-free return elsewhere.

Implied Rate of Return on Investments:

In a more general sense, implied interest rates can be used to assess the return on investments. For example, in the case of real estate, the implied interest rate can be inferred from the price of a property and the rental income it generates, helping investors assess the potential return on investment.

Calculating Implied Interest Rate

The implied interest rate can be calculated using several different methods, depending on the type of financial instrument and the available information. Below are some common methods used to calculate implied interest rates:

For Bonds:

As mentioned earlier, the most common method for calculating the implied interest rate of a bond is to determine the yield to maturity (YTM). The formula for calculating YTM is based on the present value of future cash flows (coupons and face value), discounted by the implied interest rate. While the formula can be complex and require trial and error, financial calculators or spreadsheet software can automate this process.

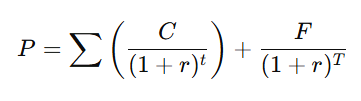

The formula to calculate YTM is:

Where:

P is the current price of the bond

C is the annual coupon payment

r is the implied interest rate (YTM)

F is the face value of the bond

t is the time period of each coupon payment

T is the total number of periods until maturity

Solving for r (YTM) can require using a financial calculator or software.

For Loans:

For a loan, the implied interest rate is the rate that satisfies the present value of the payments to the loan amount. This is often calculated using the loan amortization formula, where the interest rate is the unknown value.

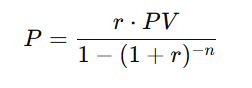

The formula for a loan is:

Where:

P is the periodic payment

r is the interest rate per period

PV is the present value or principal of the loan

n is the total number of payments

The interest rate rr can be found using iterative methods or financial calculators.

For Annuities:

The implied interest rate for an annuity can be calculated using the annuity present value formula, which involves solving for the interest rate that makes the present value of the annuity’s future payments equal to its current value.

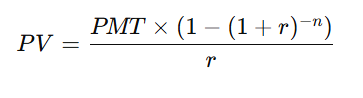

The formula for the present value of an annuity is:

Where:

PV is the present value of the annuity

PMT is the periodic payment

r is the interest rate per period

n is the total number of periods

Solving for r involves using numerical methods or tools that calculate the rate of return.

Importance of Implied Interest Rates

Comparing Financial Products:

Implied interest rates are valuable because they allow investors to compare different financial products that may have varying payment structures or terms. By calculating the implied interest rate, investors can assess the true cost of a loan, the return on a bond, or the potential returns of other financial instruments.

Market Sentiment:

Implied interest rates reflect market sentiment and expectations about future economic conditions. For example, if the implied interest rate on a bond rises, it may indicate that investors expect higher inflation or that the central bank will raise interest rates in the future.

Investment Strategy:

For investors seeking optimal returns, understanding implied interest rates helps in making informed investment decisions. It allows for the selection of bonds, annuities, or other investments that offer competitive or favorable returns relative to the risk.

Conclusion

The Implied Interest Rate is a fundamental concept in finance, providing insight into the return on investment or cost of borrowing when the rate is not directly stated. By calculating the implied interest rate, individuals and investors can make better-informed decisions, assess the attractiveness of various financial products, and optimize their investment strategies. Whether analyzing bonds, loans, annuities, or other financial instruments, the implied interest rate serves as an essential tool for evaluating the potential financial benefits or costs associated with a particular investment.