External Rate of Return (XIRR)

External Rate of Return (XIRR): A Comprehensive Guide to Evaluating Irregular Cash Flows

The External Rate of Return (XIRR) is a financial metric used to calculate the annualized rate of return for a series of cash flows occurring at irregular intervals. Unlike the Internal Rate of Return (IRR), which assumes evenly spaced cash flows, XIRR provides a more accurate measure of returns when cash flows are non-periodic. It is particularly valuable for investments or projects where cash inflows and outflows occur unpredictably, such as venture capital investments, real estate projects, or individual investment portfolios.

This guide will explore the concept of XIRR, its calculation, applications, advantages, limitations, and how it compares to other financial metrics.

What is XIRR?

The External Rate of Return (XIRR) is a tool used to determine the annualized return on investment when cash flows are irregularly timed. It essentially extends the IRR concept by incorporating the exact dates of cash flows into the calculation.

For example, if an investor deposits $10,000 into a fund on January 1, 2022, withdraws $3,000 on June 30, 2022, and then receives $12,000 on March 1, 2023, XIRR calculates the annualized rate of return for this sequence of cash flows, considering their specific timing.

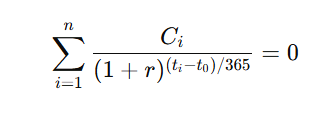

The formula for XIRR relies on iterative calculations to find a discount rate (r) that satisfies the following equation:

Where:

Ci= Cash flow at time ii (positive for inflows, negative for outflows).

ti= Date of the ii-th cash flow.

t0 = Date of the initial cash flow.

r = XIRR (annualized rate of return).

The calculation involves finding the rate (r) that equates the present value of all cash flows to zero.

How to Calculate XIRR

XIRR calculations are performed using specialized financial software or tools like Excel, which include built-in functions for this purpose. The XIRR function in Excel requires two inputs:

Cash Flows: A series of amounts representing cash inflows and outflows.

Dates: Corresponding dates for each cash flow.

Example

An investor makes the following cash flows:

January 1, 2022: Invests $10,000 (outflow, -$10,000).

June 30, 2022: Withdraws $3,000 (inflow, $3,000).

March 1, 2023: Receives $12,000 (inflow, $12,000).

To calculate XIRR in Excel:

List the cash flows and their respective dates.

Use the formula:

=XIRR(values, dates).

Result: The XIRR value represents the annualized rate of return for this investment.

Applications of XIRR

XIRR is widely used in scenarios where cash flows occur irregularly, making it a critical tool for various sectors:

Investment Portfolios

For personal or institutional investment portfolios, XIRR helps evaluate performance when deposits and withdrawals are made at random intervals.

Private Equity and Venture Capital

In private equity or venture capital investments, funding rounds, dividends, and exits often occur unpredictably. XIRR provides a reliable measure of return for these cases.

Real Estate Projects

Real estate investments typically involve irregular cash flows from construction costs, rental income, and sale proceeds, making XIRR an invaluable metric.

Loan Analysis

In scenarios where loan repayments are not evenly spaced, XIRR can help assess the effective rate of return for lenders.

Business Project Evaluation

Businesses use XIRR to assess the profitability of projects where revenues and expenses are not periodic.

Advantages of XIRR

Accurate Return Measurement

XIRR accounts for the exact timing of cash flows, providing a more precise measure of return than IRR when cash flows are irregular.

Annualized Returns

XIRR expresses returns in annualized terms, allowing investors to compare investments with different timelines effectively.

Versatility

The metric is applicable to a wide range of investment types, from personal portfolios to complex business ventures.

Real-World Relevance

Since cash flows are rarely perfectly periodic in real-world investments, XIRR reflects real-world investment performance more accurately than IRR.

Limitations of XIRR

Complexity

The calculation of XIRR is more complex than other metrics like IRR, requiring specialized tools or software.

Assumption of Reinvestment

Like IRR, XIRR assumes that interim cash flows are reinvested at the same rate, which may not always be realistic.

Multiple Solutions

For certain cash flow patterns, the equation used to calculate XIRR may yield multiple or no solutions. However, this issue is rare in practical scenarios.

Dependence on Inputs

The accuracy of XIRR depends on the reliability of cash flow data and the exact dates provided. Inconsistent or erroneous data can lead to misleading results.

XIRR vs. IRR

While both XIRR and IRR measure the return on investment, they differ in significant ways:

Cash Flow Timing

IRR assumes periodic cash flows, while XIRR accounts for the specific dates of each cash flow.

Accuracy

XIRR provides a more accurate representation of investment performance for irregular cash flows.

Use Cases

IRR is suitable for projects with evenly spaced cash flows, such as monthly loan payments. XIRR is better suited for investments or projects with non-periodic cash flows.

Practical Considerations for Using XIRR

Consistency in Cash Flow Tracking

Ensure all cash flows are accurately recorded with their corresponding dates to avoid calculation errors.

Compare Similar Investments

Use XIRR to compare investments with irregular cash flows. For periodic cash flows, IRR or other simpler metrics may suffice.

Combine with Other Metrics

While XIRR provides valuable insights, it should be used alongside metrics like Net Present Value (NPV) or Payback Period for comprehensive analysis.

Conclusion

The External Rate of Return (XIRR) is a powerful tool for evaluating the performance of investments or projects with irregular cash flows. By considering the specific timing of cash inflows and outflows, XIRR provides a more accurate and relevant measure of annualized returns than IRR in such scenarios.

Despite its complexity, XIRR is a vital metric for investors and businesses seeking to assess real-world investment performance. By understanding its applications, advantages, and limitations, stakeholders can make more informed financial decisions and better navigate the challenges of irregular cash flow patterns.