Duration

Definition:

Duration is a financial measure that reflects the sensitivity of the price of a bond or other fixed-income security to changes in interest rates. It estimates the percentage change in the bond’s price for a 1% change in interest rates and helps investors gauge interest rate risk.

Key Points:

Measurement of Interest Rate Risk: Duration shows how much the price of a bond will change when interest rates fluctuate.

Time and Cash Flow Sensitivity: Bonds with longer maturities or deferred cash flows have higher durations.

Expressed in Years: It represents a weighted average time to receive all cash flows (coupon payments and principal repayment).

Types of Duration:

Macaulay Duration: Measures the weighted average time until cash flows are received, expressed in years.

Modified Duration: Adjusts Macaulay Duration to directly estimate the price sensitivity of a bond to changes in interest rates.

Formula:

Modified Duration = Macaulay Duration / (1 + (Yield/Number of Periods per Year))

Effective Duration: Used for bonds with embedded options (e.g., callable or puttable bonds) to account for cash flow uncertainty.

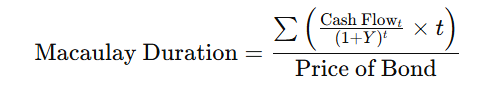

Formula for Macaulay Duration:

Where

t = Time period of each cash flow

Y = Yield to maturity (YTM)

Cash Flowt_t = Cash flow at time t

Example of Calculating Duration:

Scenario:

A bond has the following characteristics:

Face Value: $1,000

Annual Coupon Rate: 5%

Yield to Maturity (YTM): 4%

Maturity: 3 years

Steps:

Calculate the bond’s cash flows:

Year 1: $50 (coupon)

Year 2: $50 (coupon)

Year 3: $1,050 (coupon + principal repayment)

Discount each cash flow to present value (PV) using YTM:

PV= Cash Flow / (1+Y)^t

Year 1: 50 / (1.04)^1 = 48.08

Year 2: 50 / (1.04)^2 = 46.23

Year 3: 1050 / (1.04)^3 = 936.11

Compute the weighted average time:

Macaulay Duration = ((48.08 x 1) + (46.23 x 2) + 936.11 x 3)) / Bond Price

Assuming the bond price is the sum of discounted cash flows ($1,030.42):

Macaulay Duration = (48.08 + 92.46 + 2808.33) / 1030.42 = 2.89 years.

Modified Duration Example:

If the Macaulay Duration is 2.89 years and YTM is 4%, the Modified Duration is:

Modified Duration = 2.89 / 1 + 0.04 = 2.78

This indicates that for a 1% increase in interest rates, the bond’s price will decrease by approximately 2.78%.

Key Applications of Duration:

Portfolio Management: Helps investors manage interest rate risk and match liabilities with assets.

Bond Comparisons: Facilitates comparison of interest rate sensitivity across bonds with different maturities and cash flow structures.

Hedging Strategies: Assists in creating strategies to mitigate exposure to interest rate changes.

Factors Affecting Duration:

Time to Maturity: Longer maturities generally result in higher durations.

Coupon Rate: Higher coupon payments reduce duration because cash flows are received sooner.

Yield to Maturity (YTM): Higher yields reduce duration as discounted cash flows weigh less heavily in the average.

Conclusion:

Duration is a powerful tool for fixed-income investors to understand and manage interest rate risk. Whether planning for long-term goals or protecting against rate fluctuations, incorporating duration into decision-making helps ensure a balanced and resilient investment strategy.