Cash Flow Statement

Definition

The cash flow statement is one of the primary financial statements used to track the inflow and outflow of cash within a business over a specific period. It provides insights into an organization’s liquidity, operational efficiency, and financial health by categorizing cash transactions into operating, investing, and financing activities.

Purpose of a Cash Flow Statement

Monitor Liquidity: Ensures the business has sufficient cash to meet obligations.

Evaluate Performance: Assesses how well the company generates cash from core operations.

Inform Decision-Making: Helps stakeholders make informed decisions about investments, loans, and dividends.

Detect Financial Issues: Identifies potential cash shortages or inefficient cash management.

Components of a Cash Flow Statement

Operating Activities

Cash flows generated or used in the business’s primary operations.

Examples:

Cash inflows: Revenue from sales, accounts receivable collections.

Cash outflows: Payments to suppliers, salaries, rent.

Investing Activities

Cash flows related to buying or selling long-term assets and investments.

Examples:

Cash inflows: Selling equipment, proceeds from the sale of investments.

Cash outflows: Purchase of property, equipment, or securities.

Financing Activities

Cash flows related to raising or repaying capital.

Examples:

Cash inflows: Borrowing funds, issuing equity.

Cash outflows: Repaying loans, dividend payments.

Net Cash Flow

The sum of cash flows from all three activities, representing the overall change in cash position during the period.

Methods for Preparing a Cash Flow Statement

Direct Method

Lists all cash receipts and payments directly.

Example:

Cash received from customers: $60,000

Cash paid to suppliers: $30,000

Net Cash Flow from Operations: $30,000

Indirect Method

Starts with net income and adjusts for non-cash transactions and changes in working capital.

Example Formula:

Operating Cash Flow = Net Income + Depreciation – Increase in Accounts Receivable + Increase in Accounts Payable

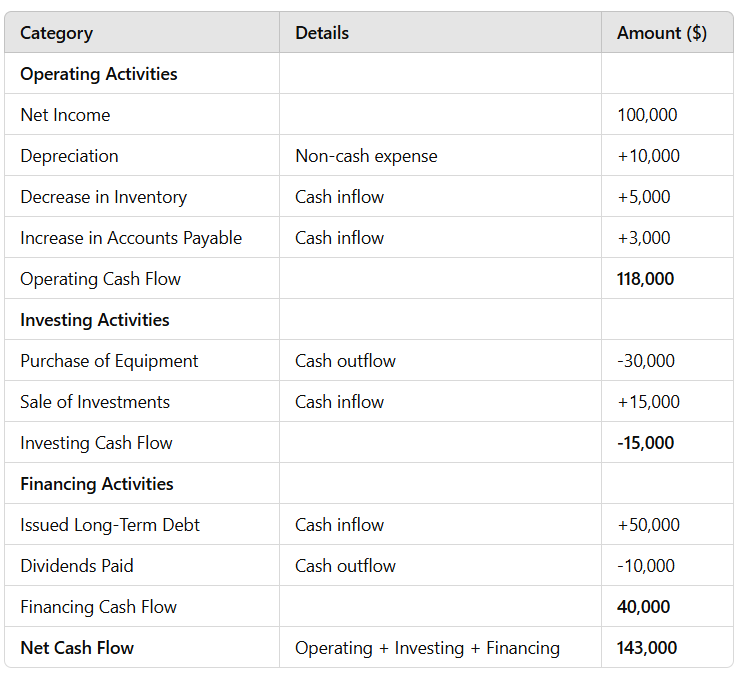

Example

ABC Corporation’s Cash Flow Statement (Year-End 2024)

Key Metrics Related to Cash Flow Statement

Free Cash Flow (FCF)

Measures the cash available after accounting for capital expenditures.

Formula:

FCF = Operating Cash Flow – Capital Expenditures

Cash Flow Coverage Ratio

Assesses a company’s ability to cover its obligations with operating cash.

Formula:

Operating Cash Flow ÷ Total Debt

Importance of Cash Flow Statements

Transparency: Highlights actual cash movements rather than just accounting profits.

Decision-Making: Helps investors and management assess the sustainability of operations.

Creditworthiness: Used by lenders to evaluate the ability to service loans.

Growth Assessment: Indicates whether the business generates enough cash to fund expansions.

Limitations

Snapshot in Time: Reflects only a specific period and may not provide long-term trends.

Not Predictive: Does not forecast future cash flows.

Requires Context: Must be analyzed in conjunction with other financial statements for a complete picture.

Conclusion

A cash flow statement is an indispensable tool for understanding a business's financial health, ensuring liquidity, and making informed financial decisions. By tracking how money moves in and out of an organization, it provides clarity about operational efficiency and long-term viability.