Bear Market

Definition:

A bear market is a period of prolonged decline in financial markets, typically characterized by a drop of 20% or more from recent highs in key market indexes, such as the S&P 500 or Dow Jones Industrial Average. It often reflects widespread pessimism and a lack of investor confidence, leading to declining asset prices.

Key Characteristics of a Bear Market:

Price Decline:

Sustained losses of 20% or more in major indexes or asset classes.

Negative Investor Sentiment:

Fear and pessimism dominate the market, leading to sell-offs.

Economic Factors:

Often tied to recessions, rising unemployment, or economic instability.

Duration:

Bear markets can last months or even years, depending on economic recovery.

Causes of a Bear Market:

Economic Slowdown:

Reduced economic activity, lower consumer spending, or declining GDP growth.

High Interest Rates:

Increased borrowing costs deter spending and investment.

Inflation:

Rising costs reduce consumer and business purchasing power.

Market Bubbles:

Overvalued assets eventually correct, triggering sharp declines.

Geopolitical Events:

Wars, pandemics, or political instability can unsettle markets.

Phases of a Bear Market:

High Prices and Investor Optimism:

The market reaches its peak, but early signs of decline emerge.

Sell-Off Begins:

Negative economic data or events lead to widespread selling.

Panic Selling:

Pessimism peaks, and prices hit their lowest point.

Stabilization and Recovery:

Markets gradually recover as confidence returns and economic conditions improve.

Examples of Bear Markets in History:

Great Depression (1929-1932):

The stock market fell nearly 90% from its peak, driven by economic collapse.

Dot-Com Bubble (2000-2002):

Overvalued tech stocks caused a 49% decline in the S&P 500.

Global Financial Crisis (2007-2009):

Housing market collapse and banking failures led to a 57% market drop.

COVID-19 Pandemic (2020):

Rapid global shutdowns caused a swift 34% decline before recovery.

Strategies for Navigating a Bear Market:

Diversification:

Spread investments across asset classes (stocks, bonds, real estate) to reduce risk.

Focus on Quality:

Invest in companies with strong fundamentals and solid cash flows.

Dollar-Cost Averaging:

Continue investing regularly to average out purchase costs over time.

Hold Cash Reserves:

Maintain liquidity to take advantage of lower prices.

Avoid Panic Selling:

Stay focused on long-term goals rather than reacting emotionally to market declines.

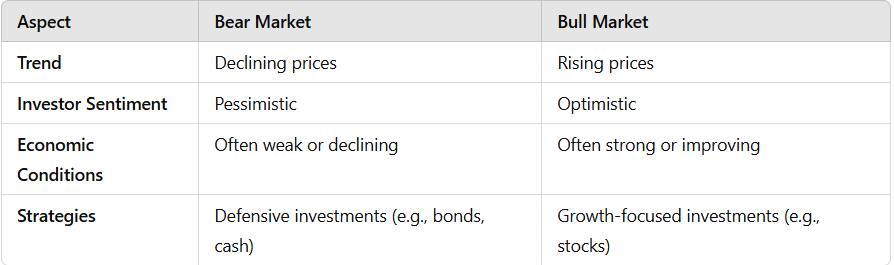

Bear Market vs. Bull Market:

Example Calculation of a Bear Market Decline:

Suppose the S&P 500 index falls from a peak of 4,000 to 3,200.

This 20% decline officially signals a bear market.

Psychological Impact:

Bear markets often trigger fear and anxiety among investors. Emotional decision-making, like panic selling, can lead to realized losses. Staying informed and maintaining a disciplined approach can mitigate these effects.

Conclusion:

A bear market is a natural part of financial market cycles, often signaling a time of economic difficulty and pessimism. While challenging, bear markets also present opportunities for disciplined investors to acquire assets at lower prices. Understanding the causes, phases, and strategies for managing bear markets can help investors navigate these downturns effectively.